The Vision 2030 Strategy

Editorially Reviewed

This content has been reviewed and verified for accuracy by our editorial team .

In 2016, Crown Prince Mohammed bin Salman revealed Vision 2030. It's an ambitious reform program. The goal is simple. Reduce Saudi Arabia's dependence on oil. Sports investment is a key part of this vision.

Vision 2030 Sports Goals

The Kingdom wants 40% of the population to be active by 2030.

Since 2015, sports participation has tripled.

Women's participation increased dramatically after 2018 policy changes.

The strategy has several clear objectives. Economic diversification comes first. Creating jobs outside oil is crucial. Tourism development is next. Major sporting events attract international visitors.

Global image enhancement matters too. They want to reposition Saudi Arabia as modern and progressive. Youth engagement is another priority. The population is young. Sports provide entertainment and opportunities.

The National Gaming Strategy

In 2022, another plan was announced. Saudi Arabia wants to be the global hub for gaming and esports by 2030. This involves creating games through Saudi studios. It means thousands of new jobs. Educational academies will open. Major international gaming events will be hosted there.

Does the Saudi Football League Make Money?

The Saudi Pro League (SPL) is not profitable. Not yet. Profitability is a long-term goal. The summer 2023 transfer window tells the story. Net expenditure was $907 million. That's a huge amount.

Financial Reality Check

Average attendance last season: 7,880 spectators per match.

That's actually down from the previous season.

Globally, the SPL ranks 56th among domestic leagues.

The financial model prioritizes investment over returns. It's similar to LIV Golf. That venture reported heavy losses too. For those interested in understanding financial calculations in sports contexts, our parlay calculator shows how different outcomes combine for potential returns.

Future Revenue Streams

Revenue is developing slowly. Broadcast rights are expanding internationally. Commercial partnerships are growing. Merchandise sales increase with star arrivals. Digital content builds global audiences.

International Broadcasting

Media deals are growing globally. Values remain modest compared to Europe.

Commercial Growth

Sponsor interest is increasing. Both Saudi entities and international brands are involved.

Merchandise Revenue

Jersey sales jump with stars like Ronaldo and Neymar.

Digital Expansion

Social media and streaming services are key to building audience.

Profitability likely comes after 2030. Current spending is market entry cost. It's about establishing global relevance first.

Do Footballers Pay Tax in Saudi Arabia?

This is a major attraction for players. Saudi Arabia has no personal income tax. For residents, this includes foreign footballers. It changes the financial equation completely.

The Tax Advantage

A €100 million salary in Saudi Arabia stays €100 million.

In countries with 50% tax rates, you'd need €200 million gross for the same net income.

This allows Saudi clubs to offer competitive net salaries. The gross cost stays lower than in Europe. Cristiano Ronaldo's deal is a perfect example. €200 million annually in Saudi Arabia. To match that net income in Europe, the gross salary would be around €400 million.

Players may still have tax obligations at home. It depends on several factors:

- Their citizenship and tax residency status

- Double taxation agreements between countries

- Income from global endorsements and investments

The tax-free environment is strategic. It's designed to attract top talent. Understanding financial advantages like this is similar to identifying value in betting markets. Our best betting strategies guide explains how to spot similar advantages.

How Much Money Has Saudi Arabia Spent?

Let's look at the numbers. They're staggering. Investments cover domestic leagues, club ownership, sponsorships, and event hosting. It's a comprehensive approach.

Transfer Spending

Summer 2023: $907 million net.

Neymar cost €90 million to Al-Hilal.

Malcom was €60 million. Rúben Neves €55 million.

Player Salaries

Cristiano Ronaldo: €200 million annually.

Neymar: €150 million annually.

Karim Benzema: €100 million annually.

Club Ownership

Newcastle United: PIF bought 80% in 2021.

Four SPL clubs are PIF-owned.

Stadium and facility development continues.

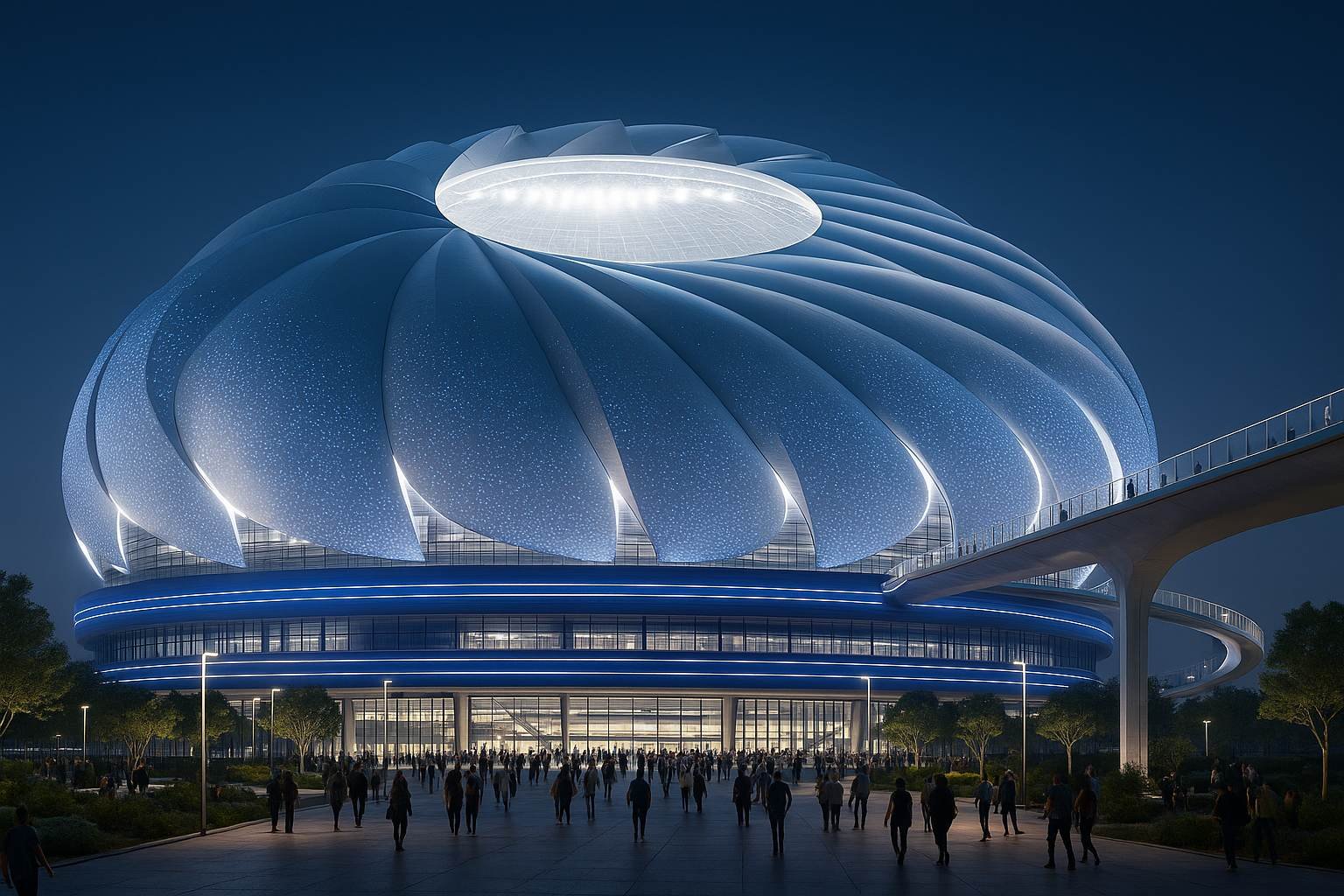

FIFA World Cup 2034

Hosting rights secured in December 2024.

Plan: 15 stadiums across 5 cities.

Investment estimate: $30-40 billion.

Total football investment since 2021 exceeds $15 billion. Much more is committed for future projects. The 2034 World Cup infrastructure is especially costly.

Sponsorship Deals

Aramco became FIFA's partner in April 2024.

The deal is worth $100+ million per year.

Visit Saudi and Neom sponsor multiple football organizations.

Understanding these massive investments requires perspective. Just as bettors use tools to analyze value, our arbitrage calculator helps identify guaranteed profit opportunities across different markets.

How Much Do Saudi Footballers Get Paid?

There's a huge gap. International stars earn fortunes. Domestic players earn much less. It's a two-tier system.

| Player Category | Annual Salary Range | Notes |

|---|---|---|

| Elite International Stars | €50-200 million | Ronaldo, Neymar level |

| Established Internationals | €10-50 million | European league veterans |

| Top Saudi National Players | €1-5 million | National team regulars |

| Average SPL Players | €300,000-1 million | Regular starters |

| Young Saudi Players | €50,000-300,000 | Developing talents |

The salary structure is deliberate. International stars bring attention. Domestic talent develops gradually. Regulations help. Clubs must maintain minimum Saudi players in squads.

"The salary gap creates opportunities and challenges. World-class talent elevates play. But a two-tier system could hinder long-term domestic development."

- Football development expert

Analyzing player value and potential returns is crucial, whether in transfers or fantasy sports. Our fantasy trade analyzer helps make informed decisions about player acquisitions and value.

Who Funds the Saudi Pro League?

The Public Investment Fund (PIF) is the main source. It's Saudi Arabia's sovereign wealth fund. Other state-owned entities contribute too.

PIF Overview

Assets exceed $950 billion.

It's one of the world's largest sovereign wealth funds.

Crown Prince Mohammed bin Salman chairs it.

Responsible for 346 sponsorships in sports.

The Club Privatisation Project

2023 brought restructuring. PIF took ownership of four clubs. Al-Ahli, Al-Ittihad, Al-Hilal, and Al-Nassr. Four other clubs went to state-owned entities. Aramco got Al-Qadsiah. The Royal Commission for Al-Ula got Al-Ula FC. And so on.

"The funding model is unique. The state, through various vehicles, competes against itself. Financial constraints that limit spending are largely removed."

- Sports economics analyst

Why is Saudi Arabia Investing in Football?

The reasons are multiple. They extend far beyond the sport itself. Each investment serves a strategic purpose.

Economic Diversification

Developing sports as an economic sector.

Reducing oil dependency is crucial.

Creating jobs in sports management and events.

Global Image Enhancement

Repositioning as modern and progressive.

Countering negative perceptions.

Building cultural soft power.

Domestic Social Development

Entertainment for a young population.

Sports participation for public health.

Creating national pride and unity.

Geopolitical Influence

Competing with Qatar and UAE.

Building international relationships.

Establishing as the Middle East's sports hub.

The Kingdom's football investments are comprehensive. Hosting the 2034 World Cup matters. Attracting global stars matters. Positioning as a major sports player matters. It's all connected.

"Saudi officials reject the 'sportswashing' label. They insist investments are about economic diversification. They talk about entertainment for their young population. But the scale suggests broader strategic objectives."

- International relations expert

Strategic thinking applies to sports analysis and betting alike. Our NFL betting strategies show how systematic approaches lead to better outcomes.

What Sports Teams Do Saudis Own?

Ownership extends beyond domestic leagues. International football clubs and other sports organizations are included.

Football Club Ownership

| Club | Owner | Acquisition Date | Stake |

|---|---|---|---|

| Newcastle United | Public Investment Fund | October 2021 | 80% |

| Al-Hilal | Public Investment Fund | June 2023 | 75% |

| Al-Nassr | Public Investment Fund | June 2023 | 75% |

| Al-Ittihad | Public Investment Fund | June 2023 | 75% |

| Al-Ahli | Public Investment Fund | June 2023 | 75% |

| Almería | Turki Al-Sheikh | August 2019 | 100% |

Other Sports Investments

- LIV Golf: Fully funded by PIF. $2 billion invested so far.

- Esports: Savvy Games Group bought ESL Gaming and FACEIT for $1.5 billion.

- Boxing: Major events through Riyadh Season.

- Formula 1: Aramco sponsorship and Saudi Arabian Grand Prix.

- Horse Racing: The Saudi Cup has a $20 million prize pool.

These are diverse investments. The strategy is clear. Build influence across multiple sports simultaneously.

Is Football in Saudi Arabia Getting Better?

Quality has improved. But challenges remain. Building a truly competitive league takes time.

Improvement Indicators

The SPL is now ranked 56th globally.

That's up from lower positions.

Global attention increased dramatically.

Viewership jumped in Mexico, France, and Brazil.

On-Field Quality Assessment

International stars raised the technical level. Positive developments are clear. Better training facilities exist. Professional standards improved. Tactical sophistication grew.

Challenges persist. A quality gap exists between stars and supporting players. Depth is limited beyond PIF-owned clubs. Attendance remains relatively low. Climate affects playing conditions.

"The Saudi Pro League is improving. But building takes decades, not years. The challenge is balancing star power with grassroots development."

- Football development specialist

Assessing improvement requires data analysis, similar to evaluating betting trends. Our odds comparison tool helps identify where real value lies across different bookmakers.

Is the Saudi League Profitable?

No. Not currently. Significant financial losses occur. It's part of a long-term strategy.

Financial Reality

$907 million transfer spending in summer 2023.

That far exceeds revenue.

Average attendance: 7,880 spectators.

Broadcast deals remain modest.

The model mirrors other Saudi sports investments. LIV Golf reported heavy losses. These ventures aren't expected to be profitable short-term.

Saudi officials view sports differently. The current phase (2021-2025) involves heavy investment. Medium term (2026-2030) builds sustainable revenue. Long term (2030+) aims for profitability.

"The Saudi Pro League isn't designed for immediate profit. It's one component of a larger strategic investment. The goal is transforming the economy and global image."

- Sports business analyst

Why Are Players Going to Saudi Arabia?

Financial incentives drive the migration. Career considerations matter too. The offers are hard to refuse.

Financial Incentives

Salaries are 2-3 times higher than Europe.

No personal income tax exists.

Substantial signing bonuses help.

Commercial opportunities increase earnings.

Career Stage Considerations

Late-career financial security matters.

Maximizing earnings in final playing years.

Reduced physical demands appeal.

Post-playing opportunities exist.

Lifestyle Factors

High-end housing is provided.

Private schooling and travel allowances.

VIP status within Saudi society.

The environment is modernizing.

Strategic Recruitment

Targeted approach identifies global appeal.

Existing stars recruit teammates.

Agent relationships are built.

European clubs get outbid regularly.

"For players in their late 20s or early 30s, Saudi Arabia offers security. It can set up families for generations. When offered three times your salary tax-free, it's hard to say no."

- Football agent

Understanding player motivations and market movements is key. Just as bettors study line movements, analyzing these trends provides insight. Our guide to reading betting odds explains how to interpret market signals.

How is Saudi Arabia Disrupting Football?

The aggressive entry creates significant disruption. Multiple dimensions of the sport are affected.

Transfer Market Disruption

- Player salaries and transfer fees inflate globally.

- A new career path exists beyond Europe.

- European clubs struggle to retain talent.

- Contract negotiations change dramatically.

Competitive Balance Impacts

- Mid-tier European leagues weaken.

- A new power center emerges outside UEFA.

- The traditional football pyramid is challenged.

- International tournament balance might shift.

Global Power Shift

The Saudi Football Federation signed 48 memorandums with federations worldwide.

Their president was elected as AFC representative to FIFA.

Aramco's FIFA partnership is worth $100+ million yearly.

Market disruption creates both risks and opportunities. Savvy bettors look for these shifts. Our hedge bet calculator helps manage risk when markets become volatile.

Is MLS Better Than Saudi?

Comparing MLS and the Saudi Pro League is interesting. They're at similar stages. But their approaches differ.

| Aspect | MLS (USA/Canada) | Saudi Pro League |

|---|---|---|

| Development Model | Gradual, sustainable growth over 29 years | Rapid, investment-heavy approach |

| Star Power | Selective star signings, focus on younger talent | Aggressive recruitment of established global stars |

| Financial Structure | Salary caps, franchise model, financial controls | Unlimited spending, state ownership, minimal constraints |

| Attendance | Average 22,500+ per match (2023) | Average 7,880 per match (2023-24) |

| Youth Development | Established academy systems, homegrown player rules | Developing academy structure, heavy reliance on imports |

| Global Ranking | Approximately 29th best league globally | Approximately 56th best league globally |

"MLS and the Saudi Pro League have different philosophies. MLS prioritized sustainability and community. The SPL compresses development through investment. Both have merits. They're different paths to relevance."

- International football development expert

Who Owns the Saudi Football Clubs?

Ownership was restructured systematically. State entities control the prominent clubs. It's part of the sports strategy.

Public Investment Fund Ownership

In June 2023, PIF took 75% ownership of four clubs:

- Al-Hilal - Most successful club in Asian football history

- Al-Nassr - Cristiano Ronaldo's club

- Al-Ittihad - 2022-23 Saudi Pro League champions

- Al-Ahli - Recently promoted back to top division

Ownership Impact

The four PIF clubs spent 77% of all transfer money in 2023.

They employ 90% of the highest-paid players.

"The ownership model is unique. The state competes against itself through various vehicles. Financial constraints that typically limit spending are removed."

- Sports economics analyst

Does Anyone Care About the Saudi Pro League?

Interest has grown significantly. Audience engagement varies by region and demographic. The numbers tell a story.

Global Attention Metrics

Public attention increased massively in Mexico (10,577%).

France saw 8,508% growth. Brazil 6,147%.

Average attendance: 7,880 per match.

Social media following increased by 1,500%+ since 2021.

"The SPL generated awareness through star signings. Converting curiosity into sustained engagement is challenging. Building authentic fan connection takes time. It can't simply be purchased."

- Sports marketing executive

Understanding audience engagement and market interest is crucial. In betting, tracking where the smart money goes is similar. Our implied probability guide explains how to read beyond surface-level odds.

Why Do Saudi Clubs Have So Much Money?

The financial resources are extraordinary. State ownership, national priorities, and oil wealth combine.

Public Investment Fund

Assets exceed $950 billion.

One of the world's largest sovereign wealth funds.

Directly owns four major SPL clubs.

Chaired by Crown Prince Mohammed bin Salman.

State-Owned Enterprises

Aramco is the world's largest oil company.

Neom is a $1.5 trillion mega-project.

Various development authorities exist.

Each owns and funds football clubs.

Strategic National Priority

Part of Vision 2030 economic diversification.

Sports are a key development sector.

Football is central to international image.

Unlimited resources are allocated.

Absence of Financial Constraints

No financial fair play regulations.

No salary caps or spending limits.

No pressure for immediate profitability.

Long-term investment perspective rules.

Understanding complex financial strategies requires proper tools. Just as Saudi Arabia calculates long-term investments, bettors need to calculate potential returns. Our ultimate sports betting guide provides comprehensive strategies for informed decision-making.